In the UK, a Phase I Environmental Site Assessment (ESA) is a Phase 1 Desk Study or Preliminary Risk Assessment, a non-intrusive report identifying potential land contamination risks for development or due diligence, involving historical research, site visits, and conceptual modelling (Source-Pathway-Receptor) to determine if further invasive testing (Phase II) is needed for planning approval.

Important Points Relating to Phase I Environmental Site Assessments

- Phase I Environmental Site Assessments are essential for commercial real estate transactions, providing crucial liability protection under CERCLA

- Knowing the difference between Phase I, II, and III assessments can help realtors guide their clients through potential environmental complications

- Not conducting a Phase I ESA can lead to substantial remediation costs and significant liability exposure for your clients

- A properly conducted Phase I ESA typically takes 2-4 weeks and costs between $2,000-$5,000, a small investment compared to potential liability costs

- Realtors who are knowledgeable in environmental due diligence have a valuable competitive advantage in commercial real estate

Environmental issues can stop property transactions in their tracks faster than almost anything else. Understanding Phase I Environmental Site Assessments (ESAs) isn’t just useful for realtors—it’s essential for protecting your clients and your reputation. This comprehensive guide will give you the knowledge to handle environmental due diligence with confidence, turning potential deal-breakers into manageable situations.

Contact an Environmental ConsultantHow Phase I Environmental Site Assessments Can Impact Your Real Estate Transactions

Your client’s perfect commercial property could be concealing an expensive environmental disaster. Was there a gas station on the site in the 1970s? There might be underground storage tanks leaking pollutants into the soil. Was a dry cleaning business located in the building next door? Chemicals could have seeped onto your client’s potential property. Without a Phase I ESA, these hidden environmental risks stay undetected until it’s too late—after the closing documents are signed and your client is legally responsible.

During my career working with commercial properties, I’ve witnessed $2 million deals fall apart in an instant when basic environmental due diligence uncovered contamination issues that would have cost $500,000 to fix. The wise realtor doesn’t view environmental assessments as hurdles but as chances to show value and expertise to clients. A comprehensive environmental assessment offers reassurance and valuable negotiating power when problems are found.

“Phase 1 Environmental Site Assessment …” from www.cool-ox.com and used with no modifications.

What is a Phase I ESA and Why is it Important for Realtors?

A Phase I Environmental Site Assessment is a thorough examination of a property’s present and past usage to identify any potential environmental contamination hazards. It is essentially an environmental background check for a property, conducted in accordance with ASTM Standard E1527-21. The assessment determines if the property may have been contaminated with hazardous substances or petroleum products, but it does not involve the collection of soil, groundwater, or building material samples.

Phase I ESAs are of utmost importance to you as a realtor because they serve as the first line of defense against environmental liability for your clients. A Phase I ESA, when properly conducted by a qualified environmental professional, can provide your client with innocent landowner protection under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA)—commonly known as the “Superfund” law. Without this protection, your clients could be held accountable for cleanup costs even if they didn’t cause the contamination.

What Exactly is a Phase I Environmental Site Assessment?

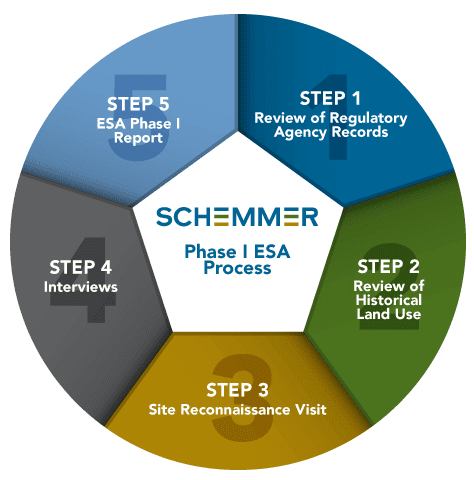

A Phase I ESA is a comprehensive evaluation of a property’s environmental risk profile, and it involves four main steps.

The first step is a thorough review of records, which includes looking at government environmental databases, records of the property’s historical use, aerial photographs, topographic maps, and building department records, sometimes going back several decades.

The second step is a site reconnaissance, which involves a qualified environmental professional physically inspecting the property to look for visible signs of potential contamination.

The third step is conducting interviews with the current owners and occupants of the property, as well as local government officials, to gather information that might not be available in written records.

The fourth and final step is to compile all of the findings into a detailed report, which will identify any Recognized Environmental Conditions (RECs) and provide recommendations for further action, if necessary.

When it comes to commercial properties, the assessment usually takes about 2-4 weeks and costs somewhere between $2,000-$5,000. This depends on the size of the property, how complex it is, and where it’s located.

Even though it might seem like just another cost in an already expensive process, it’s a drop in the bucket compared to what you might have to pay for remediation costs or legal liabilities if you don’t do your due diligence.

Why Every Deal Needs CERCLA Protection

“Continuing Obligations …” from terradex.com and used with no modifications.

Contact an Environmental ConsultantDid you know that the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) can hold property owners accountable for cleaning up contamination, even if they didn’t cause it? This is called “strict liability” and it means that your clients could buy a property today and end up being responsible for contamination that happened years ago. But there’s good news: CERCLA includes an “innocent landowner defense” that can protect buyers who conduct the right due diligence before purchasing a property.

For your clients to be eligible for this vital protection, they must carry out “all appropriate inquiries” into the previous ownership and uses of the property before purchasing it. This requirement is met by a Phase I ESA conducted according to ASTM standards by a qualified environmental professional. Without this protection, your clients could be liable for potentially unlimited environmental cleanup costs, which can easily amount to millions of dollars. As their realtor, assisting clients in understanding and obtaining this protection shows your value beyond simply facilitating a transaction.

What Sets Phase I, II, and III Assessments Apart

Environmental site assessments are generally conducted in three phases, each more intensive and detailed than the last. A Phase I ESA is non-invasive and identifies potential issues through a review of records and a visual inspection. If Recognized Environmental Conditions (RECs) are discovered during Phase I, a Phase II ESA may be suggested, which includes actual testing of soil, groundwater, or building materials to confirm contamination. A Phase III ESA is only carried out when contamination is confirmed and involves the creation and execution of a remediation plan.

Quick Overview of Environmental Assessment Phases

Phase I: Identifies potential problems through records and visual inspection

Phase II: Verifies contamination through sampling and testing

Phase III: Creates and executes remediation plans

Having a grasp on this sequence can help you manage your clients’ expectations. A Phase I ESA that uncovers RECs doesn’t necessarily mean the deal is off—it just means further investigation is required. Many RECs end up being manageable problems after Phase II testing, while others might warrant price renegotiation or special contract provisions instead of completely abandoning the deal.

- Phase I ESA identifies potential environmental risks without physical sampling

- Phase II ESA confirms or rules out contamination through scientific testing

- Phase III ESA creates and implements a cleanup plan for confirmed contamination

- Each phase becomes progressively more expensive and time-consuming

- Not all properties that require a Phase I ESA will need to progress to Phases II or III

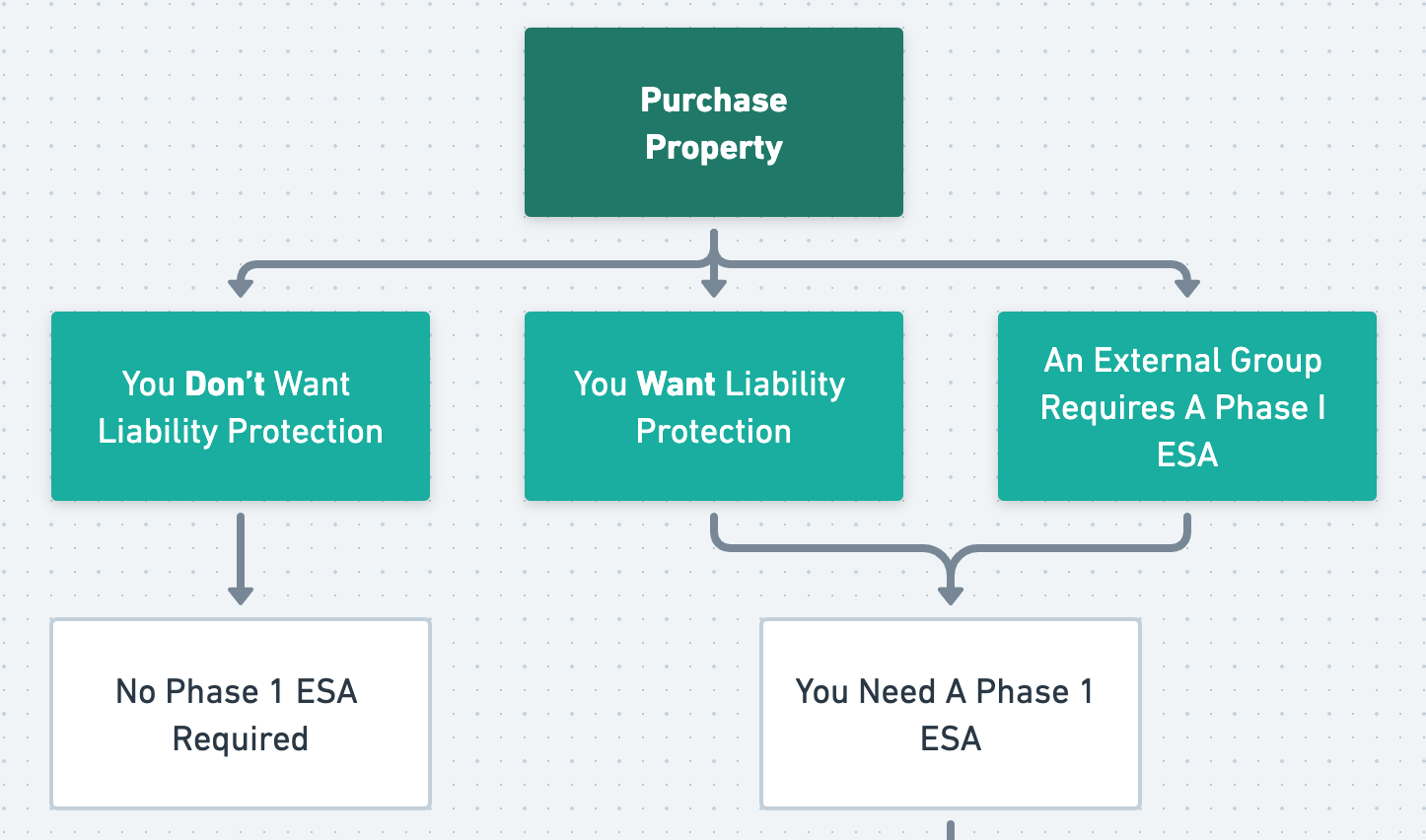

When You Absolutely Need to Recommend a Phase I ESA to Clients

“Phase I ESA | Strategic Property Buying …” from www.schemmer.com and used with no modifications.

While a Phase I ESA is valuable for virtually any property transaction, there are certain scenarios where it becomes absolutely essential. Knowing when to strongly recommend environmental due diligence demonstrates your professional expertise and helps protect both your clients and your reputation. The following situations should trigger immediate consideration of a Phase I ESA.

1. Commercial Real Estate Transactions

It’s virtually guaranteed that a Phase I ESA will be required for commercial properties, no matter their current use. The larger investments and higher stakes of commercial transactions mean the potential liability exposure is much greater than residential transactions. Furthermore, most commercial lenders require a Phase I ESA as part of their due diligence before they approve financing. If your client doesn’t have one, they may not be able to get financing, which could force them to look for alternative, usually less favorable, financing options or they could potentially lose the deal altogether.

Commercial properties often have a more complicated history of use, which raises the chances of finding environmental problems. A building that currently houses an apparently harmless retail store may have previously been a manufacturing plant, auto repair shop, or chemical storage warehouse. Without a thorough investigation, these historical uses and their potential impacts are hidden risks that your client unknowingly takes on when purchasing.

2. Buying Industrial Properties

From an environmental standpoint, industrial properties are some of the riskiest acquisitions. Factories, manufacturing plants, warehouses, and processing plants often use, store, or produce dangerous materials as part of their operations. Even when current operations appear clean, previous industrial activities over the decades may have left contamination in the soil or groundwater. The types of contaminants associated with industrial sites are often the most costly to clean up, with cleanup costs easily reaching into the millions for severe cases.

Aside from the property itself, industrial sites are often grouped together, which means that contamination from nearby properties can move onto your client’s potential purchase. A Phase I ESA not only evaluates the target property but also the surrounding properties that could affect environmental conditions. This wider perspective is vital for industrial acquisitions where contamination issues across the area are common.

3. Properties Close to High-Risk Operations

Being near certain types of facilities can significantly increase environmental risk, even if the property itself has never been home to potentially contaminating operations. Gas stations with underground storage tanks, dry cleaners that use chlorinated solvents, auto repair shops, printing facilities, and landfills all pose migration risks to nearby properties. Contaminated groundwater is a particular concern, as it doesn’t respect property lines and can travel great distances, bringing pollutants onto properties that were previously clean.

If your client is thinking about a property next to or downstream from these high-risk operations, a Phase I ESA is especially crucial. The assessment will pinpoint these proximity worries and assess whether contamination migration is a real risk based on elements such as groundwater flow, soil conditions, and the type of nearby operations. To understand the impact of nearby operations, consider the environmental impact assessment best practices for onshore wind farm projects.

4. What Lenders Want

Most lenders have their own environmental due diligence requirements that need to be met before they’ll finance a real estate deal. If you’re getting a government-backed loan through the Small Business Administration (SBA), Housing and Urban Development (HUD), or USDA, you’ll almost always need a Phase I ESA. Most commercial lenders also have their own environmental policies and will require at least a Phase I assessment for loans backed by commercial real estate.

Even if a lender doesn’t specifically demand a full Phase I ESA, they might carry out their own environmental screening which might uncover issues and therefore require a full assessment. By suggesting a Phase I ESA from the beginning, you’re helping your client avoid any delays in financing and showing professional foresight, which builds trust in your services.

5. Past Land Uses That Are Cause for Concern

There are some past uses of a property that automatically necessitate an environmental investigation, no matter what the current conditions are. Former gas stations are one of the most frequent environmental issues in real estate because underground storage tanks may still be present many years after the station has closed. Likewise, properties that used to be dry cleaners, manufacturing plants, auto repair shops, junkyards, or agricultural operations with heavy pesticide use all have a higher environmental risk.

If your research uncovers that a property was once used as a landfill, was a site for mining, or was part of a military installation, it’s likely that significant contamination occurred. If you find out any of these historical uses through your initial research or local knowledge, it’s not just a good idea to recommend a Phase I ESA, it’s necessary to protect your client.

The True Price of Ignoring Environmental Due Diligence

“Environmental Due Diligence …” from www.taisei-sx.jp and used with no modifications.

Contact an Environmental ConsultantYour clients may feel enticed to save a few bucks and some time by skipping a Phase I ESA, but this could lead to disastrous results. The initial cost of environmental due diligence may seem steep, but it is nothing compared to the potential financial blow of finding contamination after buying the property. By understanding these consequences, you can better explain to your clients why proper environmental assessment is so important.

Scary Liability Situations: Real Stories of Deals That Went Badly

Think about the story of a small business owner who bought a former gas station property in 2018 without doing a Phase I ESA. Three years later, when they were expanding their building, the construction workers found three abandoned underground storage tanks that were leaking petroleum into the soil around them. The cost to clean it up was over $350,000—which was almost as much as the original purchase price—and the business had to be closed for six months while the remediation work was being done. If a Phase I ESA had been done, these tanks would have been found before the purchase was made, and the buyer could have negotiated with the seller to take care of the problem or chosen a different property.

Consider a situation where a developer bought an old warehouse property with the intention of transforming it into a mixed-use retail and residential space. To speed up the closing process, they decided to forego the Phase I ESA. It was later discovered that the property had been used to store industrial chemicals in the 1960s. During construction, groundwater contamination was discovered, which led to the project being put on hold while environmental agencies conducted an investigation. The developer ended up having to pay over $1.2 million in remediation costs, the project was delayed by more than 18 months, and they had to spend a significant amount of money on legal fees to fight with the previous owner over who was liable. If they had conducted a Phase I ESA, which would have cost less than $5,000, they would have been aware of this risk before buying the property.

The Impact of Environmental Problems on Real Estate Values

When it comes to property values, environmental contamination can have a significant impact. Typically, property values will drop dramatically when contamination is discovered, often far more than the cost of cleaning up the contamination. This “stigma of contamination” can linger even after the cleanup is finished. Properties that were once contaminated often sell for 10-30% less than properties that were never contaminated. For commercial properties, environmental problems can also affect rental rates, the ability to keep tenants, and the ability to market the property. This can lead to long-term financial issues that go beyond the cost of cleaning up the contamination, especially in cases of landfill gas migration.

Environmental problems can also significantly limit financing options, as the majority of lenders refuse to accept contaminated property as collateral. This effectively removes most potential buyers from the market when your client eventually decides to sell, forcing them to either remediate first or accept significantly discounted offers from cash buyers willing to assume the environmental risk. The liquidity impact alone can drastically change the investment calculus, turning what seemed like a good deal into a financial anchor.

Understanding the Cost of Cleanup

Remediation costs can vary greatly depending on the type and extent of the contamination, as well as the local regulatory requirements. However, these costs are often a shock to property owners who are not prepared. The cost of soil remediation for petroleum contamination often starts at around $100 per cubic yard. Even a small spill can affect hundreds of cubic yards. Groundwater contamination is even more expensive. The cost to install a remediation system can range from $250,000 to $500,000. The annual operating cost can range from $25,000 to $50,000. This could potentially go on for decades. If there are hazardous materials like lead, asbestos, and PCBs in the building structures, this adds another layer of complexity and expense to redevelopment projects.

Leveraging ESA Results for Negotiations

When used strategically, environmental findings can be a valuable tool during negotiations. When a Phase I ESA reveals potential problems, smart realtors don’t immediately start worrying—they see the situation as a chance to make the most of it. Minor RECs can justify price cuts that are higher than the actual costs of remediation, which instantly creates equity for your buyer. For sellers who are dealing with environmental issues, having a Phase I ESA done proactively allows you to present solutions at the same time as problems, which means you can keep your negotiating power rather than rushing to respond to a buyer’s findings.

Establishing Escrow for Potential Cleanup

When environmental problems emerge but both parties still want to continue with the transaction, environmental escrow accounts offer a graceful solution. This approach involves reserving a part of the purchase price in escrow to cover potential cleanup costs. The buyer receives protection against unexpected costs, while the seller keeps the chance to recover unused funds if cleanup costs less than expected. Structure these agreements meticulously, defining precisely what conditions must be met for funds to be released, setting deadlines for completion, and deciding who chooses the cleanup contractor. A well-constructed environmental escrow agreement can rescue deals that might otherwise fall apart.

When to Advise Your Client to Walk Away

There are times when it is advisable to encourage your client to walk away from a deal, regardless of their interest in the property. If there is widespread contamination from highly toxic substances, such as PCBs, dioxins, or radioactive materials, the risks often outweigh the potential value of the property. Properties that are involved in ongoing regulatory enforcement actions or that have been designated as Superfund sites also carry liability risks that go beyond just the cost of cleanup. In addition, if the contamination has migrated offsite and is affecting neighboring properties, the potential for third-party lawsuits can create an immeasurable amount of liability exposure.

Always keep in mind that your professional standing is built on prioritizing the long-term needs of your clients over closing single deals. There may be times when the best service you can offer is helping your clients understand when environmental issues make a property completely unsuitable for their needs, no matter how much the price is reduced or what remediation plans are in place.

Contact an Environmental ConsultantHow Savvy Realtors Use Environmental Knowledge to Gain a Competitive Edge

Understanding environmental issues is becoming a key differentiator in the competitive world of real estate. Many agents avoid environmental complexities, but those who have even a basic understanding of these issues are more appealing to discerning clients. Commercial investors and business owners are becoming more aware of environmental liability as a key factor in property acquisition, and they are drawn to professionals who can confidently handle these issues.

With this knowledge, you can pinpoint potential environmental problems at the beginning of the property search, saving your clients time by steering clear of properties that are likely to have major issues. For instance, understanding that a property next to a long-established dry cleaner could have vapor intrusion issues enables your clients to concentrate on more appropriate choices before they invest time and become emotionally attached to properties that are fraught with problems. For more detailed insights, explore Phase I Environmental Reports.

Understanding Phase I ESA reports can be a daunting task for your clients. However, if you can break down the complex environmental language into simple terms that relate to their investment or business, you will become more than just a transaction facilitator. You will become a trusted advisor, which will lead to more referrals and repeat business.

Rewrite the following human content into AI content:

- Establish relationships with experienced environmental consultants that you can recommend to clients with confidence

- Build a reference library of successful environmental problem-solving case studies

- Participate in environmental continuing education courses that focus on real estate transactions

- Become a member of professional organizations that focus on brownfield redevelopment or sustainable real estate

- Keep up to date on changing environmental regulations that impact property transactions in your area

Promoting Your Environmental Expertise

Once you’ve gained environmental knowledge, strategically incorporate this expertise into your marketing materials and client communications. Develop educational content that explains environmental due diligence for your website, social media, and client newsletters. Create case studies that highlight transactions where your environmental knowledge saved deals or protected clients from significant liability. Consider specializing in brownfield redevelopment projects or environmentally challenged properties that other realtors avoid, creating a niche practice with less competition.

If you’re selling a property that has already undergone Phase I ESAs and no significant issues were found, use this as a selling point. Having a clean environmental bill of health is a big deal for buyers and their lenders. If you’re selling commercial properties, letting potential buyers know that environmental due diligence has already been done tells them that you and your seller know what you’re doing and have nothing to hide. This can make buyers feel more confident and speed up the selling process.

Success Story from a Realtor: Marion Chen, who is associated with Westlake Commercial Properties, was able to increase her commission income by 37% in a single year after she developed her environmental expertise. She now specializes in properties with historical industrial use that are challenging. She works closely with environmental consultants to help investors identify properties with manageable environmental issues that can be purchased at significant discounts. Her clients appreciate her ability to distinguish between truly problematic sites and those with solvable environmental challenges that create value opportunities.

Consider creating a simplified environmental checklist for clients that helps them understand potential red flags when viewing properties. This tangible tool demonstrates your expertise while providing genuine value during the property search process. Even basic guidance like noting historical operations that often cause contamination (gas stations, dry cleaners, manufacturing) helps clients evaluate properties with a more sophisticated eye. Learn more about how to become an environmental engineer to further enhance your expertise.

Working With Environmental Consultants

Realtors who prioritize environmental concerns often have strong relationships with environmental professionals. These relationships offer access to expert advice when environmental questions come up and allow for quick preliminary assessments before clients invest in full Phase I ESAs. Many environmental consultants will conduct courtesy reviews of properties you’re considering showing to clients, helping you identify potential issues before recommending a property. This pre-screening process saves everyone time and builds your reputation for thorough professionalism.

Here are some tips for finding a qualified environmental consultant:

- Look for consultants who are certified as Environmental Professionals under ASTM standards.

- Choose firms that have experience specifically in supporting real estate transactions.

- Make sure they have the appropriate professional liability insurance.

- Ask for references from lenders who regularly review their reports.

- Consider the consultant’s responsiveness and their ability to explain technical findings in plain language.

Don’t forget that environmental consultants can be a great source of referrals. They work with a lot of commercial and industrial property buyers who need qualified real estate professionals. By showing that you know about the environment and that you’re professional, you make yourself their first choice to refer to when their clients need a real estate expert.

Contact an Environmental ConsultantCommon Questions

Environmental site assessments can be a confusing topic for many, whether they are seasoned commercial property buyers or first-time investors. Answering these common questions can help you demonstrate your knowledge and help your clients navigate this complex process. The answers to these common questions can help you begin a discussion about environmental due diligence with your clients.

Remember that environmental laws differ from state to state and even from city to city, so always check the specific requirements with environmental professionals who are familiar with the regulatory framework in your area. The general advice below is a good starting point for these crucial discussions.

Will a property fail a Phase I ESA if contamination is detected?

Unlike a traditional test, a Phase I ESA doesn’t produce a “pass” or “fail” result. Instead, it identifies Recognized Environmental Conditions (RECs) that suggest the potential presence of contamination. The identification of RECs doesn’t mean that contamination is present, but rather that a Phase II ESA might be necessary for further investigation. Even when a Phase I ESA identifies potential issues, many transactions are successful, particularly when the issues are well-defined and manageable.

The most important thing is whether the conditions identified pose significant risks to human health, the environment, or your client’s investment. An experienced environmental professional can help determine whether RECs are serious concerns or manageable problems. Sometimes, what sounds frightening in an environmental report actually poses little practical risk or liability exposure. This professional interpretation helps clients make informed decisions rather than emotionally reacting to technical terms.

What happens if a property deal gets delayed and the Phase I ESA expires?

ASTM standards state that a Phase I ESA is good for about six months, or 180 days. After that, it needs to be updated to stay in compliance with CERCLA liability protections. If it’s been more than a year, you’ll likely need to start from scratch with a new assessment. This is because the condition of the property and its regulatory status can change, potentially creating new environmental issues that weren’t found in the first assessment.

Do any properties get a pass on Phase I ESA requirements?

Although no properties are completely exempt from environmental liability under CERCLA, some transactions do qualify for less stringent due diligence requirements. For instance, residential properties with one to four dwelling units often qualify for the “residential property exemption” under ASTM standards, which requires less thorough investigation. In the same way, some rural agricultural properties may qualify for simplified assessments that focus specifically on pesticide and fertilizer use instead of concerns about industrial contamination.

How does a Property Condition Assessment differ from a Phase I ESA?

Property Condition Assessments (PCAs) and Phase I ESAs are not interchangeable and have distinct purposes. A PCA assesses the physical state of a property’s improvements, such as structural elements, mechanical systems, roofing, and other components. Its main purpose is to identify deferred maintenance and estimate future capital needs. It primarily concentrates on the buildings rather than the environmental conditions of the land beneath them.

On the other hand, a Phase I ESA zeroes in on potential environmental contamination and the associated liability. Both assessments involve site visits by qualified professionals, but they examine different aspects of the property and require different areas of expertise. Most commercial transactions benefit from both assessments: the PCA looks at physical improvement conditions and the Phase I ESA looks at environmental liability concerns. Neither assessment can replace the other, and skipping either one leaves significant due diligence gaps that could prove costly.

Contact an Environmental Consultant